In the nearly five years since the release of Ludicrous: The Unvarnished Story of Tesla Motors, we have learned a lot more about who Elon Musk actually is. Where once we had little more than a cipher on which to project new great man theories of history, now we have a biography, countless interviews, and a seemingly endless flood of tweets in which to discern the personality at center of one of the great techno-economic phenomena of our time. Not all this evidence can be taken at face value, but as it accumulates and as Elon Musk’s story continues to play out, it’s worth noting how and where past anecdote and current reality meet up.

Nowhere is this intersection more compelling than in the stories of Musk’s experience as a gambler. Dave Karpf’s excellent “Elon Musk and the Infinite Rebuy” uses one of these stories, from Walter Isaacson’s recent biography of Musk, to reveal the yawning vacuum behind both the man and his popular mythology. The story of Musk playing poker with former PayPal cofounder Max Levchin, in which he goes all-in on every hand and keeps re-buying fresh chips until he hits a winning hand, is profoundly reflective of Musk’s broader story. As Karpf puts it, it is “a story of good fortune, not a story of inherent greatness.”

More recently, Musk’s father has told an even more revealing tale of Musk’s formative experience with gambling, in one of his regular plays for a piece of his son’s fame (or infamy, it doesn’t seem to matter to the elder Musk). In a bizarre interview with The Sun, Errol Musk describes sneaking an underage Elon (along with his brother and eventual Tesla board member Kimbal) into a casino in order to exploit his “system” for winning roulette. This system turns out to have been about as sophisticated as Elon’s poker strategy, as Errol explains: “By simply assuming that red would follow black or vice versa, we wagered quite large amounts for beginners. After particularly good winnings on one occasion, we hit the great exclusive restaurant and dined on langoustines and filet mignon.”

In this evocative tableau we have a remarkable metaphor for the last decade or so of Musk’s runaway entrepreneurial success. At its heart, the basic thesis that has propelled Tesla into one of the most remarkable stock booms in modern memory is as compellingly logical on its surface yet utterly shallow under any kind of scrutiny as the idea that red should statistically follow black. Yes, on a long enough timeline material realities and political trends make electric vehicles “the future” on an abstract level (much as black and red will theoretically hit in equal numbers given sufficient spins of the roulette wheel), but that is hardly a guarantee that Tesla as an organization, or its very specific approach to electric vehicle technology, will singlehandedly usher in and dominate that theoretically likely outcome.

Sure enough, nearly five years after the release of my book, which argued that the specific aspects of Tesla’s culture and approach to EVs were more important than the abstract theories underlying the bull narrative, the view that equated betting on Tesla with betting on EVs more broadly has fallen apart. Not to crow too much here, but it’s done so in the ways I specifically warned about: a lack of long-term planning, an inability to develop the discipline required to make truly affordable mass-market cars, and an over-reliance on stock pumping hype that long ago boiled over into outright fraud. If Musk brings a genuine skill set to his otherwise reckless gambling, it’s his remarkable ability to keep a simple, elegant and deeply wrong narrative viable for as long as he has.

Just as his gambling career surfed a wave of his father’s wealth, Musk’s career as an entrepreneur has surfed a wave of immense bias towards the tech sector tropes that have underpinned Tesla’s investment narrative, leaving the company profoundly exposed as faith in its basic assumptions finally ebbs. This is most evident in Tesla’s aging product lineup, where the stock-pumping profits of recent years turn out to have come at the expense of reinvestment in new sheetmetal. First in China and then Europe and the US, Tesla continues to prove that interior and styling refreshes can’t revive in the face of crushing competition. The theory that Tesla could defy industry’s capital-intensive need to reinvest in all-new models reflected far too much faith in its ability to port a “platform strategy” from the world of software into the very different world of cars, as well as an absurd belief that a vague “innovation moat” (personified in Musk) would keep Tesla one step ahead of the competition.

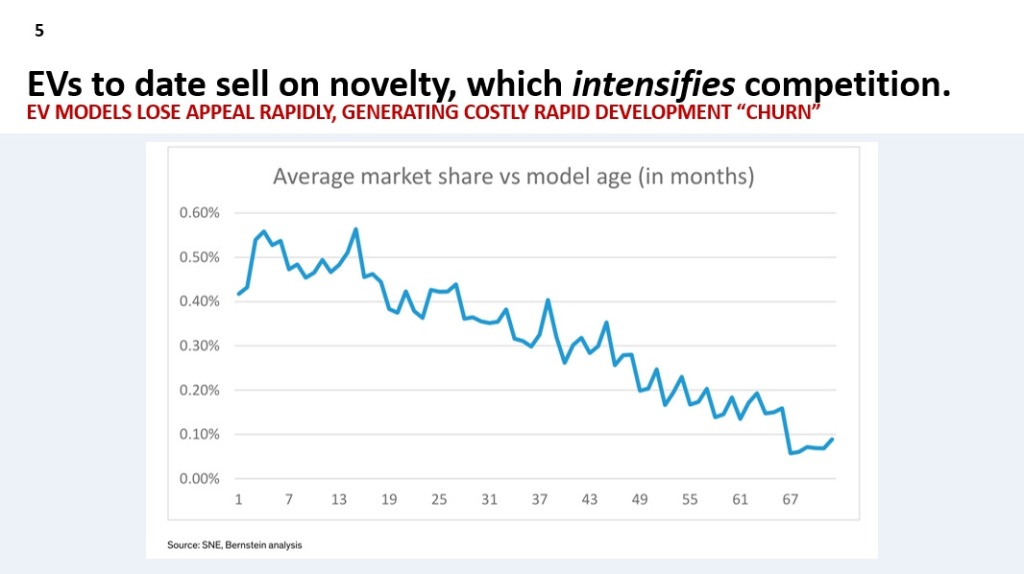

The idea that Tesla doesn’t have to take the competition seriously has deep roots in its overconfident online fan-investor complex, which has long reflected the hubris of a teenager who thinks his success gambling daddy’s money is actually proof that he’s figured out a “system” for roulette. In fact, as Tesla grew complacent and reaped windfall profits during the COVID undersupply, both legacy and startup automakers were dumping product into the heart of Tesla’s market, turning it into a trend-driven treadmill. As the chart above (borrowed from Glenn Mercer’s indispensable Car Charts substack) shows, Tesla has been standing still as the premium EV market it once dominated transforms into a churning, high-fashion brawl. With so many models from so many companies chasing a limited pool of premium buyers, novelty has become the be-all-end-all and Tesla’s window to leverage its massive early lead and invest in its core lineup to stay ahead has already passed it by.

Then again, to reinvest in new versions of the Model S/X and 3/Y would have required huge amounts of capital and may only have served to defend market share rather than return Tesla to the heady growth levels that its investors have grown comfy taking for granted. Tesla didn’t get this far by following the proven paths of success in the capital-intensive low-margin auto business, and it’s likely that doing so now would have alienated as many investors as failing to do so has. Critically, leveraging Tesla’s technical advantages into a low-cost electric vehicle would have similarly mired Musk in the dreary, spreadsheet-driven grind of the traditional auto industry, where neither he nor many of his investors want to be.

Instead, Tesla is going back to a now-familiar well by going “balls to the wall,” in Musk’s juvenile phrasing, on driving automation technology. But here too Tesla is attempting to surf a wave that has already expended much of its strength, after what will have been eight years of selling self-driving fairy dust this October. It’s been possible (though unpopular) to utterly debunk Tesla’s entire approach to driving automation for nearly a decade now, but I’ll save that task for another time. At this point no technical understanding is necessary to see that Musk has promised the Kingdom of Self-Driving Heaven on Earth by the end of the year so many times, and with so little effort to explain why he has been so consistently wrong about this string of predictions, that this genre of stock pump belongs in a category of religio-capitalism with the likes of such freaks as Zion Oil and Gas.

In this final choice, electing to hype a nonsensical robotaxi using a thoroughly debunked approach to driving automation instead of shoring up Tesla’s crumbling core car business, we see the logical conclusion of what this story has always been: a gambler who found himself in an industry that bankrupted most (if not all) of its gamblers a century ago. Musk’s ability to capture the public imagination and leverage popular narratives about technology gave Tesla a totally unpredictable opportunity to succeed at the car business, but rather than solidifying and protecting the nearly 2 million unit/year business he created against all the odds, he just kept doubling down on hype. And unlike William C. Durant, whose wild stock market gambling run created General Motors, Tesla doesn’t have a board of directors or investor base capable of ditching him in favor of an Alfred P. Sloan type to tackle the very different challenges of leading a maturing automaker with real scale.

It is here, in Tesla’s investor base, where Musk’s commitment to gambling over building a real business creates the risk of an almost unthinkable unwinding of the company’s very real accomplishments. As the market-expanding Model 3 and Y hit their stride Tesla began printing real profits, particularly during the COVID undersupply, the core cultist fanbase was increasingly augmented by more serious (please be mindful of how low this bar was) investors. For years now, seasoned Wall Street managers like Gary Black (ex Harvard, Goldman, Janus, etc) have helped derisk Tesla stock by taking focus off the hilariously absurd self-driving and humanoid robot gambles, and reframing Tesla’s valuation as being primarily about the only slightly less absurd prospect of endless growth and profits from its core car business.

With Tesla’s business of making and selling cars falling apart, and with nothing to revive its fortunes than the rolling monument to Musk’s out of touch arrogance known as the Cybertruck, Black fully capitulated over the weekend. His self-assessment reveals how thin the façade of his grown-up expertise really was, as he turns out to have been engaged in the same kind of basic high-confidence, low-evidence speculative Calvinball as every other Tesla bull. All it takes to be the adult in a room full of Tesla investors is to be skeptical of “Full Self-Driving,” and hope Elon invests in the core car business until even Lloyd Christmas can no longer muster a faltering “so you’re telling me there’s a chance.”

With Black and his fellow Adult Tesla Investors fleeing the sinking ship, Tesla’s base of support is regressing to the degenerate gambler mean set by Musk’s long example. Cultists like Jason DeBolt, who countered Black’s capitulation with a heartfelt paean to the joys of Tesla-based homelessness, are once again the face of this company’s investor base. Once you’ve convinced people to pay five figures so their car will someday work for them as a robotaxi, strung them along for the better part of a decade, and then announced that you’re actually building a dedicated robotaxi model after all, these are the kinds of folks you are left with. Only those with the immense sense of destiny unique to the gambler on a hot streak can keep up with Musk, as he embarks on the last chapter of his world-historical ego trip.

Leave a comment